Floor limits were of more significance when most credit card merchants processed transactions by taking a physical imprint of the card rather than electronically swiping the magnetic.

Floor limit vs credit limit.

A floor limit describes how much money a credit card holder is able to use without the need for authorization from the creditor.

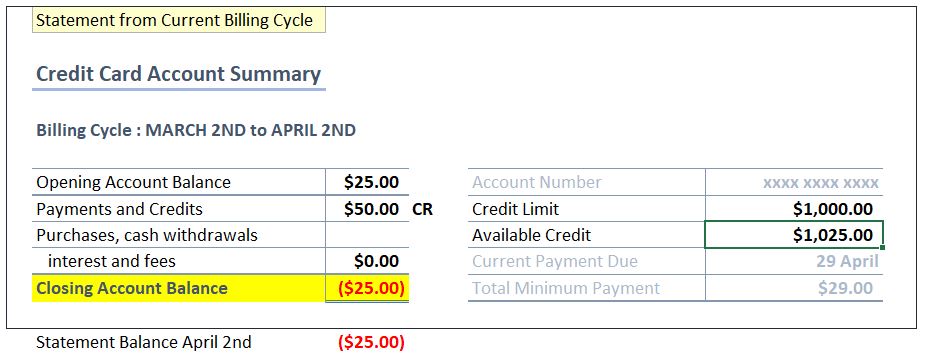

The term credit limit refers to the maximum amount of credit a financial institution extends to a client.

The floor limits usually come into.

The amount of money that can be charged in a transaction before a credit or debit card must go through the authorization process.

This limit is determined between the creditor and the credit card holder before the holder receives the card so there are no mysteries between the two.

The term floor limit comes from the days when it was the maximum amount which could be approved on the floor of the retailer beyond which the cash register operator would have to call for approval.

An amount that visa and mastercard have established for single transactions at specific types of merchant outlets and branches above which authorization is required.

In credit card purchases the maximum amount the merchant can charge to the buyer s card without getting authorization.

The limit can vary from.

Floor limit noun an amount above which a credit card sale must be authorized by the card company varying from one shop etc to another main entry.

Floor useful english dictionary.

Additionally lower value transactions are accepted without sending the transaction online for verification by the acquiring host.

A lending institution extends a credit limit on a credit card or a line of credit.

For a charge above the floor limit the merchant must obtain authorization from the card issuer.

Pin signature or biometric authentication.

The standard floor limit may vary according.

For transactions over the defined cvm limit a verification is usually required e g.

Limits may vary between banks.

The floor limit is a predetermined limit set by the merchant and the creditor.

A zero floor limit means every credit card transaction has to be authorized.

A purchase amount over which further authorization is needed by the merchant.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)